Question Number 120563 by rexfordattacudjoe last updated on 01/Nov/20

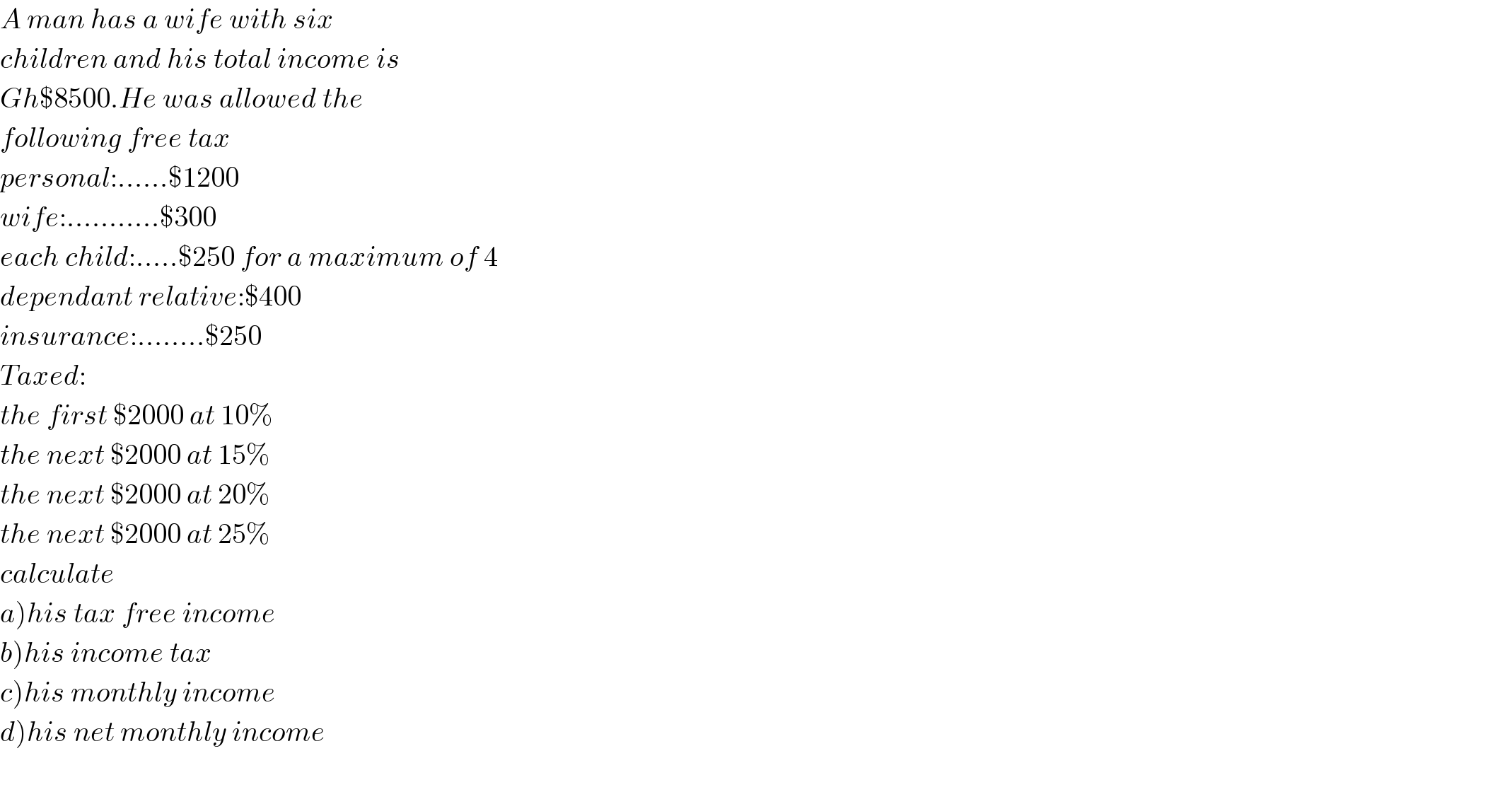

$${A}\:{man}\:{has}\:{a}\:{wife}\:{with}\:{six} \\ $$$${children}\:{and}\:{his}\:{total}\:{income}\:{is} \\ $$$${Gh\$}\mathrm{8500}.{He}\:{was}\:{allowed}\:{the} \\ $$$${following}\:{free}\:{tax} \\ $$$${personal}:……\$\mathrm{1200} \\ $$$${wife}:………..\$\mathrm{300} \\ $$$${each}\:{child}:…..\$\mathrm{250}\:{for}\:{a}\:{maximum}\:{of}\:\mathrm{4} \\ $$$${dependant}\:{relative}:\$\mathrm{400} \\ $$$${insurance}:……..\$\mathrm{250} \\ $$$${Taxed}: \\ $$$${the}\:{first}\:\$\mathrm{2000}\:{at}\:\mathrm{10\%} \\ $$$${the}\:{next}\:\$\mathrm{2000}\:{at}\:\mathrm{15\%} \\ $$$${the}\:{next}\:\$\mathrm{2000}\:{at}\:\mathrm{20\%} \\ $$$${the}\:{next}\:\$\mathrm{2000}\:{at}\:\mathrm{25\%} \\ $$$${calculate} \\ $$$$\left.{a}\right){his}\:{tax}\:{free}\:{income} \\ $$$$\left.{b}\right){his}\:{income}\:{tax} \\ $$$$\left.{c}\right){his}\:{monthly}\:{income} \\ $$$$\left.{d}\right){his}\:{net}\:{monthly}\:{income} \\ $$$$ \\ $$

Answered by prakash jain last updated on 01/Nov/20

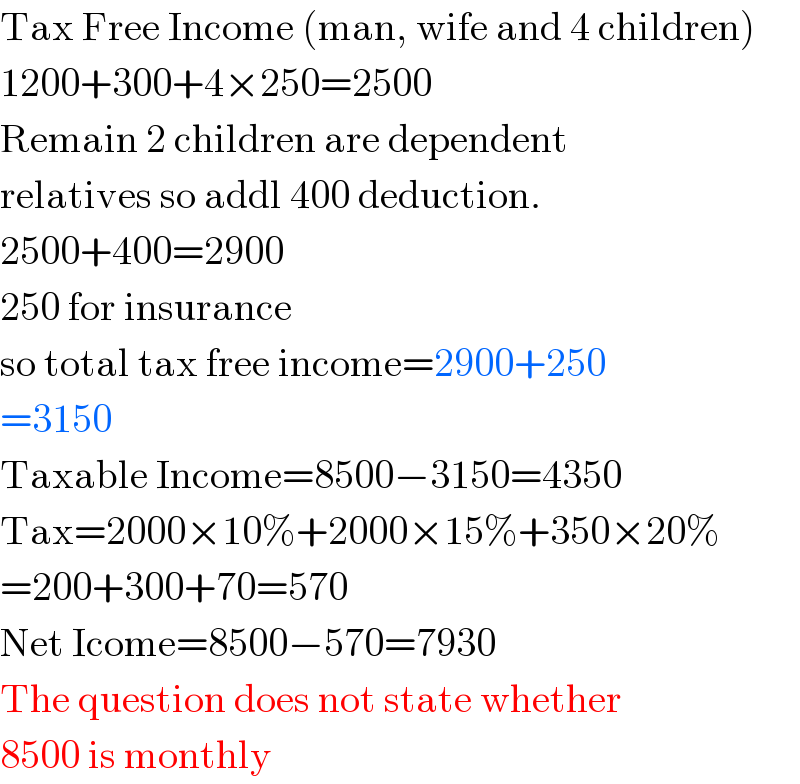

$$\mathrm{Tax}\:\mathrm{Free}\:\mathrm{Income}\:\left(\mathrm{man},\:\mathrm{wife}\:\mathrm{and}\:\mathrm{4}\:\mathrm{children}\right) \\ $$$$\mathrm{1200}+\mathrm{300}+\mathrm{4}×\mathrm{250}=\mathrm{2500} \\ $$$$\mathrm{Remain}\:\mathrm{2}\:\mathrm{children}\:\mathrm{are}\:\mathrm{dependent} \\ $$$$\mathrm{relatives}\:\mathrm{so}\:\mathrm{addl}\:\mathrm{400}\:\mathrm{deduction}. \\ $$$$\mathrm{2500}+\mathrm{400}=\mathrm{2900} \\ $$$$\mathrm{250}\:\mathrm{for}\:\mathrm{insurance} \\ $$$$\mathrm{so}\:\mathrm{total}\:\mathrm{tax}\:\mathrm{free}\:\mathrm{income}=\mathrm{2900}+\mathrm{250} \\ $$$$=\mathrm{3150} \\ $$$$\mathrm{Taxable}\:\mathrm{Income}=\mathrm{8500}−\mathrm{3150}=\mathrm{4350} \\ $$$$\mathrm{Tax}=\mathrm{2000}×\mathrm{10\%}+\mathrm{2000}×\mathrm{15\%}+\mathrm{350}×\mathrm{20\%} \\ $$$$=\mathrm{200}+\mathrm{300}+\mathrm{70}=\mathrm{570} \\ $$$$\mathrm{Net}\:\mathrm{Icome}=\mathrm{8500}−\mathrm{570}=\mathrm{7930} \\ $$$$\mathrm{The}\:\mathrm{question}\:\mathrm{does}\:\mathrm{not}\:\mathrm{state}\:\mathrm{whether} \\ $$$$\mathrm{8500}\:\mathrm{is}\:\mathrm{monthly} \\ $$