Question and Answers Forum

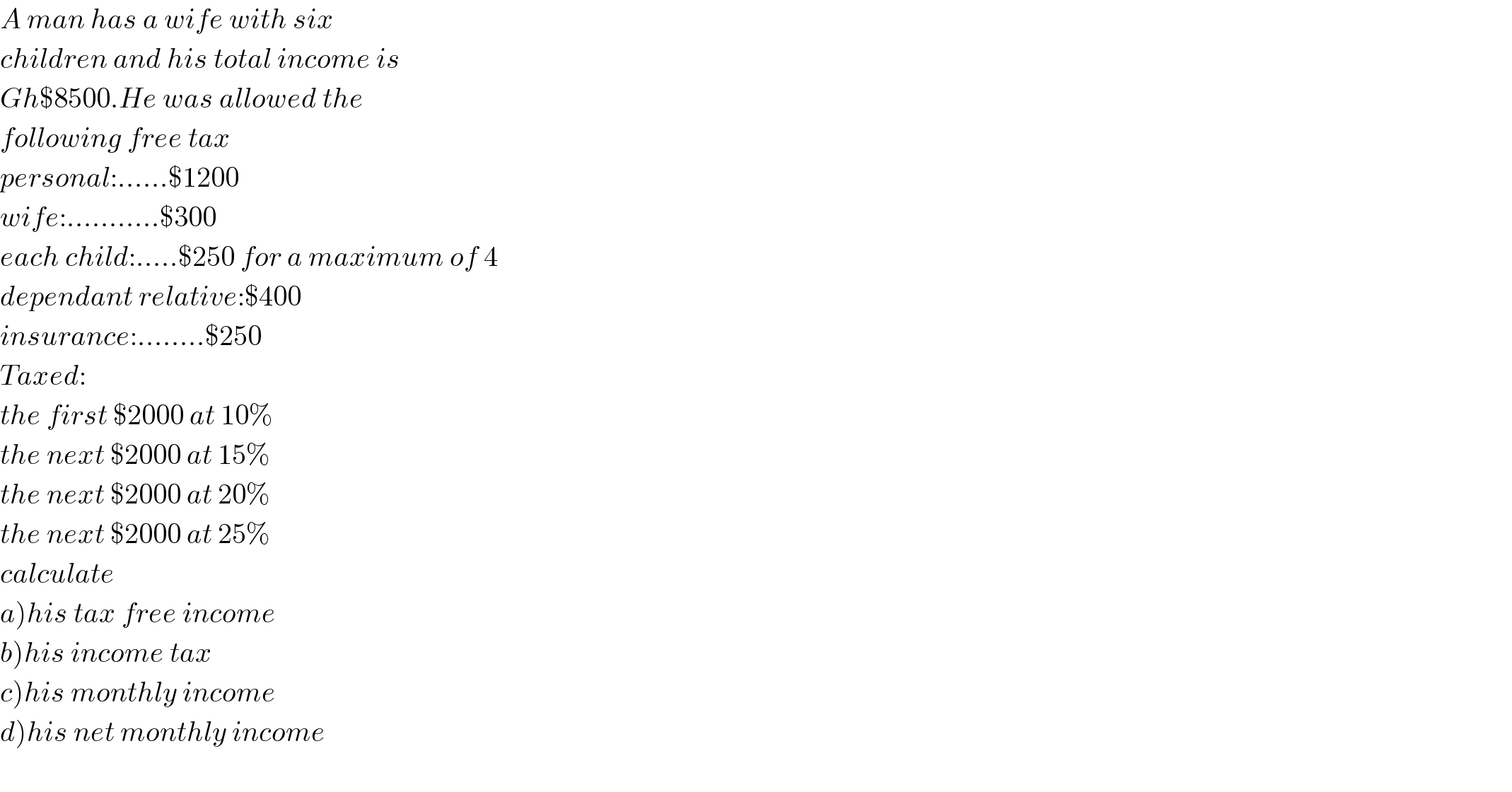

Question Number 120563 by rexfordattacudjoe last updated on 01/Nov/20

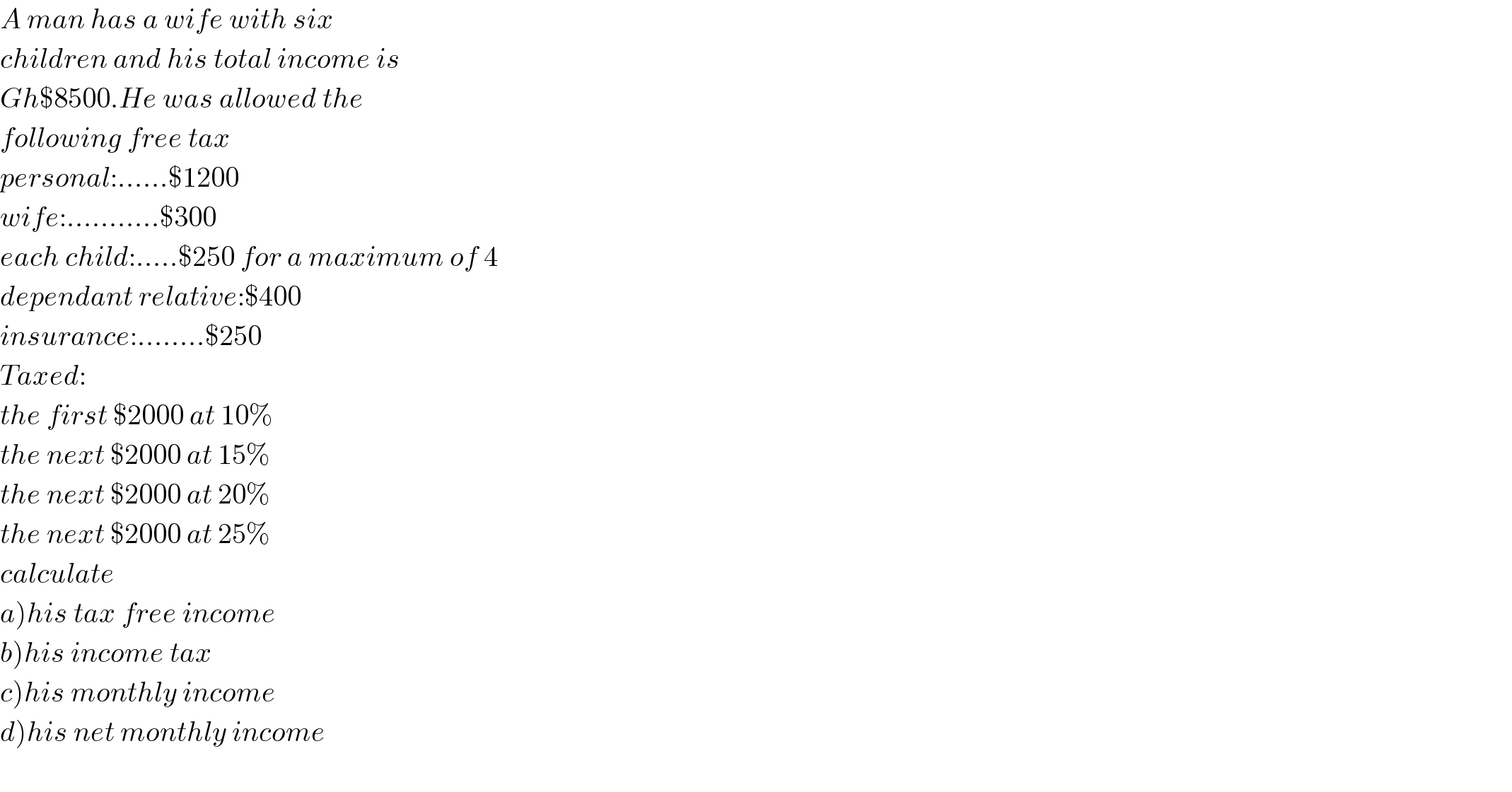

Answered by prakash jain last updated on 01/Nov/20

| ||

Question and Answers Forum | ||

Question Number 120563 by rexfordattacudjoe last updated on 01/Nov/20 | ||

| ||

Answered by prakash jain last updated on 01/Nov/20 | ||

| ||

| ||