Question and Answers Forum

Question Number 175240 by Best1 last updated on 24/Aug/22

Commented by Best1 last updated on 25/Aug/22

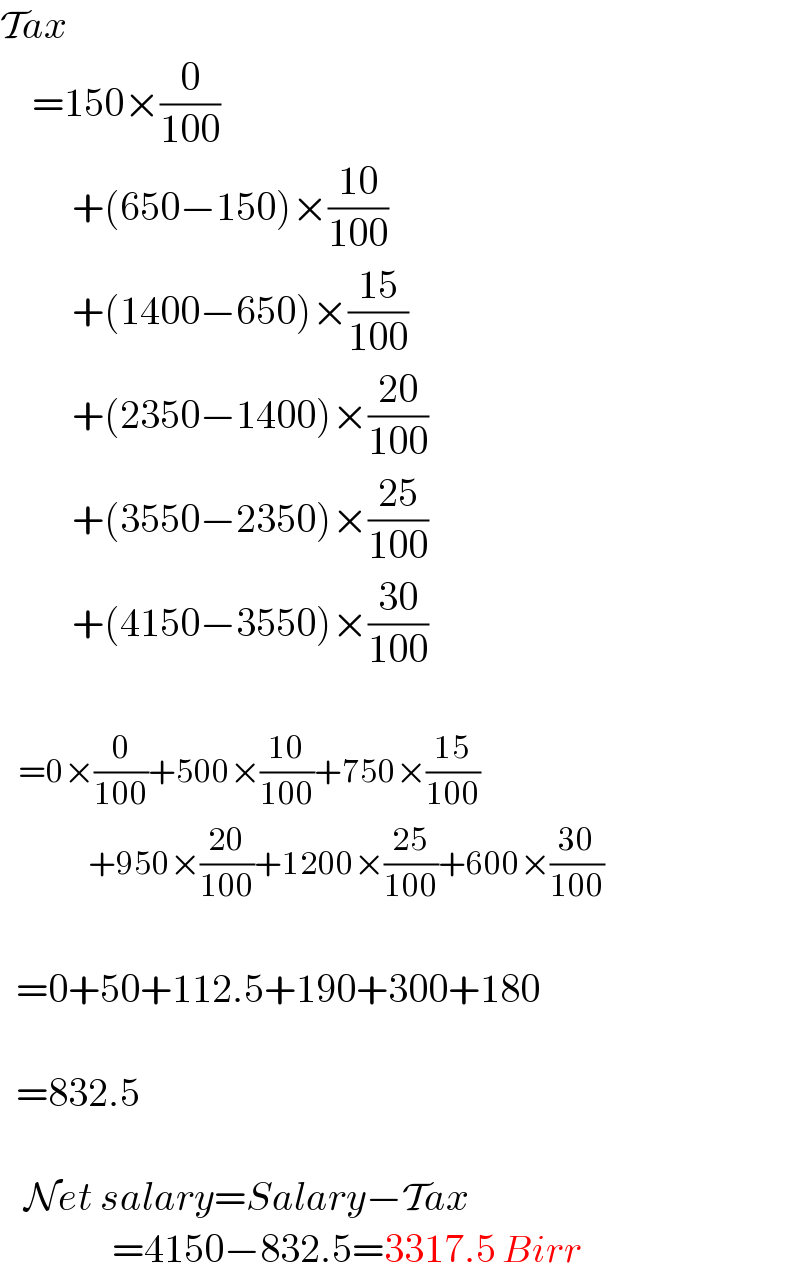

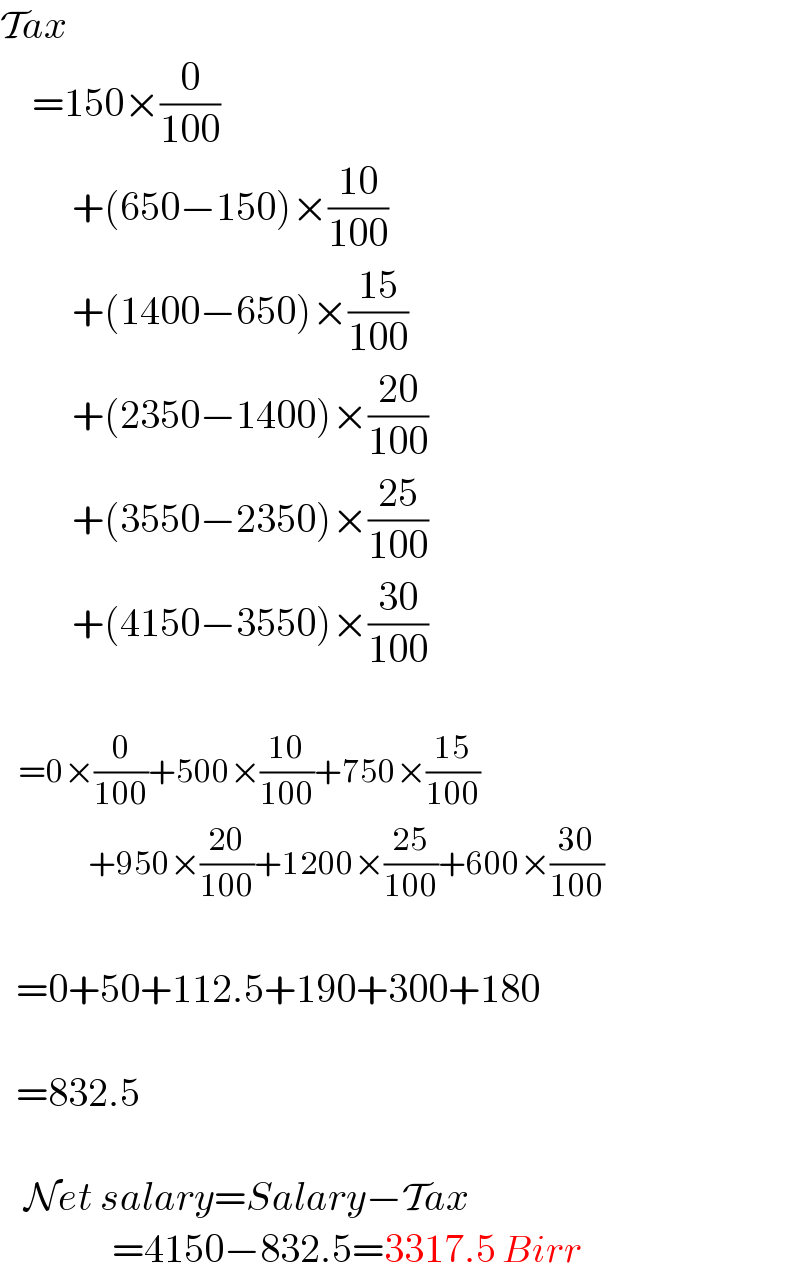

Answered by Rasheed.Sindhi last updated on 25/Aug/22

Commented by Best1 last updated on 25/Aug/22

| ||

Question and Answers Forum | ||

Question Number 175240 by Best1 last updated on 24/Aug/22 | ||

| ||

Commented by Best1 last updated on 25/Aug/22 | ||

| ||

Answered by Rasheed.Sindhi last updated on 25/Aug/22 | ||

| ||

| ||

Commented by Best1 last updated on 25/Aug/22 | ||

| ||